Table of Content

The objective with which I joined Springboard was quite clear - gainful employment by the end of the course with the help of strong data science content and curation. My objective was cleared within 3 months of joining the course. Highly recommended for young professionals trying to break into the Data Science fields or seasoned professionals trying to switch laterally. Springboard the transition of occupations so much easy. Activities with one task at a time made the program easy to understand.

I had a very positive experience w/ Springboard's Data Analytics Career Track. I think that you really can get a very good idea of what means to be a Data Scientist. The material is designed for any person with any type of background to understand clearly. It was good experience with attractive subjects and many applied practices. I think some parts should be explained more for better instruction.

How much could I borrow on a springboard mortgage?

Whatever your situation, at OnlineMortgageAdvisor we know that everyone's circumstances are different. That's why we only work with expert brokers who have a proven track record in securing mortgage approvals. Furthermore, if after 3 years there's arrears on the Mortgage Account then the funds will be held on to by Barclays until the account is brought back up to date and remains in the black for at least 12 months.

Starting your journey to becoming a homeowner with us is easy. First, you'll need to apply for a pre approval. We can usually process this on the same day you apply. Lock in your rate and payments over a 5 year period by opting for the 5 year fixed rate. Springboard CDFI dba Springboard Home Loans is an independent nonprofit mortgage lender and is not affiliated with any housing counseling agencies, or their providers or grantors.

Consumer Protection

Get more reviews from your customers with Birdeye. There are a select number of lenders who are now offering this product and equivalents. Get Started with an expert broker to find out exactly how much you could borrow. We will match you to a real human being who's an expert in your circumstance with a proven track record at finding mortgage wins. Book a call and an expert broker will call you back at your preferred time, within 24 hours. Once your pre-approval is confirmed, our dedicated mortgage specialists will guide you through the rest of your application.

In my experience it's worth the money though. People who write reviews have ownership to edit or delete them at any time, and they’ll be displayed as long as an account is active. From the beginning Jonathan and his team have been very professional and provided the support that I needed. Please note that this is an example and not representative of all lenders.

Company activitySee all

The Springboard team is also very professional and been helpful all along. At OnlineMortgageAdvisor we know that everyone's circumstances are different. That's why we only work with specialist brokers, who are experts in securing mortgage approvals. Having the extra security from your family’s savings might even boost your chances of getting a mortgage with certain types of bad credit on your file.

In fact, some lenders will stipulate that the person making the savings deposit seeks independent advice before proceeding. This is based on 4.5 times your household income, the standard calculation used by the majority of mortgage providers. To borrow more than this, you will need to use a mortgage broker to access specialist lenders. The information on the site is not tailored advice to each individual reader, and as such does not constitute financial advice. All the advisors we work with are fully qualified to provide mortgage advice and work only for firms that are authorised and regulated by the Financial Conduct Authority. They will offer any advice specific to you and your needs.

What happens if the mortgage payments are missed?

Do note, while we always aim to give you accurate product info at the point of publication, unfortunately price and terms of products and deals can always be changed by the provider afterwards, so double check first. We think it's important you understand the strengths and limitations of the site. We're a journalistic website and aim to provide the best MoneySaving guides, tips, tools and techniques, but can't guarantee to be perfect, so do note you use the information at your own risk and we can't accept liability if things go wrong. Call a couple of solicitors, I am sure you will be fine finding a solicitor.

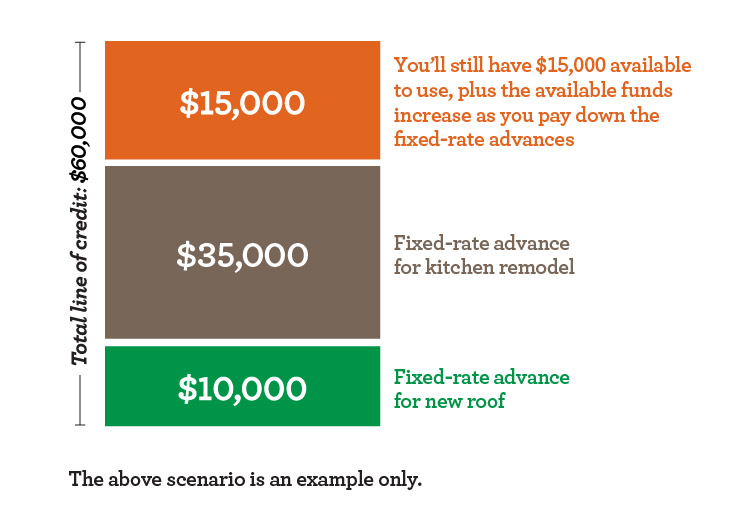

Most will cap at4xannual income (so someone earning £25k would not be able to borrow more than £100k), some will offer up to5x income, and a handful even up to6x incomein the right circumstances. The benefit of a springboard mortgage is that they usually allow you to purchase at a more attractive rate than for a traditional 95% deal, because the risk to the lender is in effect, 85% of the property value. Your family member provides the security for your mortgage by offering collateral equal to or up to 20% of the property purchase price .

Compare our latest mortgage rates and understand our fees. Our Family Springboard Mortgage allows first-time home buyers the ability to purchase their dream home with little or no down payment, so long as their family or loved ones can provide additional security for the down payment shortfall. You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice. This program gave me such an incredible skillset that has landed me so many interviews and opportunities.

As with all mortgages, repayments must be made on time. If you are unable to meet your mortgage payments, your parent’s money can be held until the mortgage repayments are up to date. Most lenders calculate affordability using a more complex model these days, but in general will cap loans to amultiple of your earnings.

Interviewers are so impressed with the data analysis and presentation combination. I couldn't say enough good things about this program. The great mentors, 24/7 assistance, flexible schedule, networking, and all online. Additionally, I think that the support from mentors, community, advisors, etc. is wonderful to guide you in the correct pathway to succeed.

I feel like Denise treats my customers as she would a friend, which is exactly what Mighty Gum is all about. If you approach these lenders directly, you’ll be dealing with their own in-house broker, who works for the lender, not you. They often do a hard search of your credit, which will leave marks on your credit history. What also plays a part is thetype of income you earn, and the amount of other financial commitments you have . The more variable/less reliable the income, the fewer the lenders, and the more debt you have, the less a lender will be prepared to offer you. A buyer wants to purchase a property for £200,000, puts up £10,000 deposit (5%), borrows £190,000 (95%), and parents deposit £20,000 (10%) into an account for 5 years .

Family springboard mortgage

The cash introduced to the account attracts interest for the ‘helper’. In effect, it is additional security against the mortgage. The balance in the Helpful Start Account would attract interest, currently at 1.61% AER. This is a relatively attractive return when compared to savings accounts. Well, the mortgage is offered by Barclays Bank and it’s designed to help those looking to buy their own home and get onto the property market when they have little or no deposit to put down.

A family springboard mortgage, or family deposit mortgage, could be an option if you’re unable to raise enough deposit to get on the property ladder on your own. You’ll need a family member who’s happy to help you out financially by placing savings into an account held by the lender; but these agreements can be mutually beneficial for you and them. But before you press ahead, you should consider speaking to a mortgage broker who specialises in springboard mortgages. They can guide you through every step of the process and make sure you find the lender offering the best rates, first time. We always recommend gaining advice from one of the expert mortgage advisors we work with before applying for a springboard mortgage as it’s a huge commitment for all parties involved.