Table of Content

Customers said that the process dragged out over weeks, not days, and that they were still denied a loan at the end - despite meeting all of the criteria for income, loan-to-value, and so forth. Many clients had a hard time getting a response from Spring HQ representatives. Others said that they paid $250+ for a drive-by appraisal that significantly undervalued their home, compared with other reliable evaluations of the property. Our reviewers evaluate products and services based on unbiased research.

But one of the biggest financial reasons to own your own home is to start building home equity. In the event SoFi serves as broker to Spring EQ for your loan, SoFi will be paid a fee. For additional disclosures related to the SoFi Invest platforms described above, including state licensure of SoFi Digital Assets, LLC, please visit SoFi.com/legal. 3) Cryptocurrency is offered by SoFi Digital Assets, LLC, a FinCEN registered Money Service Business. SoFi Invest refers to the three investment and trading platforms operated by Social Finance, Inc. and its affiliates . Individual customer accounts may be subject to the terms applicable to one or more of the platforms below.

Home Improvement Loans

The platform offers relatively flexible loan terms ranging from 24 to 84 months. Aside from the varying loan limits, there are significant differences between FHA loans and conventional loans. Conforming conventional loans are available for properties with one to four units.

While OneMain doesn’t disclose its minimum credit score, the lender doesn’t use the FICO credit score in its underwriting. Instead, OneMain relies on the borrower’s ability to pay their loan while covering existing debts. Similarly, the company doesn’t disclose its income or DTI ratio, saying it reviews every application using various factors. LightStream is a flexible and user-friendly platform that offers personal loans with high upper limits. Credible isn’t an online lender but connects people with other personal loan lenders. If you’re shopping around looking for the best debt consolidation loan, an aggregate site like Credible can save you plenty of time by making it easy to compare various options from other companies.

Summary of the Top Recommended Debt Consolidation Loan Companies

The platform uses an AI algorithm to evaluate applicants across several unique factors, including education, job history, and current residence, to decide whether to grant loan approval. If you don’t meet the credit score or income requirements, you may consider applying with a co-applicant, who will be jointly responsible for paying off the loan. It’s important to note that a co-applicant isn’t the same as a co-signer, who assumes responsibility for the loan if the main applicant cannot pay.

Lenders will qualify borrowers based on the full line of credit draw even if the line has a zero balance. This may be something to consider if you expect to take on another home mortgage loan, a car loan, or other debts in the near future. If you aren’t able to make payments and go into loan default, the lender could foreclose on your home. And if the HELOC is in second lien position, the lender could work with the first lienholder on your property to recover the borrowed money. Taking out a HELOC is placing a second mortgage lien on your home.

Keep Your First Mortgage

Here are some instances when it may make sense to borrow an unsecured personal loan over a secured equity loan or HELOC. When you borrow a personal loan, or any improvement loan funded in a lump sum, it’s helpful to know how much you will need, since overborrowing could mean paying more in interest than necessary. If you can’t afford to pay off your mortgage early in its entirety all at once, you can chip away at the loan over time by making more than the minimum monthly payment. If making a larger down payment isn’t possible, you might also be able to speed up your equity earnings — and save money on interest over time — by paying off a mortgage early.

Plus, some lending platforms give you the ability to compare offers from multiple banks with a single online form, saving you time while connecting you with the best rates on the market. For borrowers with less-than-perfect credit scores, Avant offers loans for those with a minimum credit score of 580. Whether new to the borrowing scene or working to repair or rebuild credit, borrowers who may not qualify for personal loans elsewhere may clue into this lender as one possible solution. We evaluated numerous online loan providers to find the best personal loans for debt consolidation. Our analysis consisted of various factors, including those that affect the quality of the loan and those that showcase the lender’s reliability.

First, it’s important to understand that the term home equity loan is simply a catchall for the different ways the equity in your home can be used to access cash. The most common types of home equity loans are fixed-rate home equity loans, home equity lines of credit , and cash-out refinancing. You are now leaving the SoFi website and entering a third-party website.

Some platforms cater to applicants with low credit scores, but these personal loans may have prohibitively high interest rates. An alternative would be to find a lender offering secured personal loans that can lower your loan’s APR. SoFi home equity loans provided by Spring EQ could save you as much as $530 on your monthly payment. A home equity loan usually has a fixed interest rate and monthly payment, and you get the entire amount of the loan upfront as a lump sum. A HELOC, or home equity line of credit, lets you take out money as needed up to a predetermined credit limit. However, HELOCs almost always have variable interest rates, so you could be paying more in interest depending on when you withdraw the funds.

Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. SoFi is a one-stop-shop for personal finance, including mortgage lending.

Most lenders require you to have at least 15-20% equity in your home. In other words, if your home is worth $400,000, you need to owe less than $320,000 to $340,000 in order to qualify for a home equity loan. Keep in mind that these calculations are based on the current appraised value of your property, not the purchase price. Spring HQ has an overall solid reputation, but we still found some complaints.

With so many resources available today, particularly online, it's easy for investors of all experience levels to get ... Home Improvement Loans Where can you find the best home improvement loans? If you're looking to finally renovate that kitchen straight out of the 70's, or build on the extra bedroom you need, chances ... OneMain’s minimum loan amount is $1,500 in most states, though Alabama, California, Georgia, North Dakota, Ohio, and Virginia all have higher loan minimums. The maximum loan amount is $20,000 in almost every state except North Carolina, which has a limit of $7,500. LightStream’s minimum loan amount is $5,000 in all states, and the maximum is $100,000, though these amounts may vary due to an applicant’s qualifications and needs.

All information in the primary residence payment examples listed above — including interest rates, payments, terms, and availability — is for informational purposes only and is subject to change without notice. Lenders typically require you to maintain at least 20% equity in your home . The application can be completed easily online and you’ll have access to customer service 24/7 to help support you throughout the loan process. The higher your credit rating, the less of a perceived risk you are to lenders, having a history of managing your credit well could make it easier to get approved or to obtain better loan terms overall. •Smaller home improvement loans (e.g, bathroom or kitchen as opposed to full remodel).

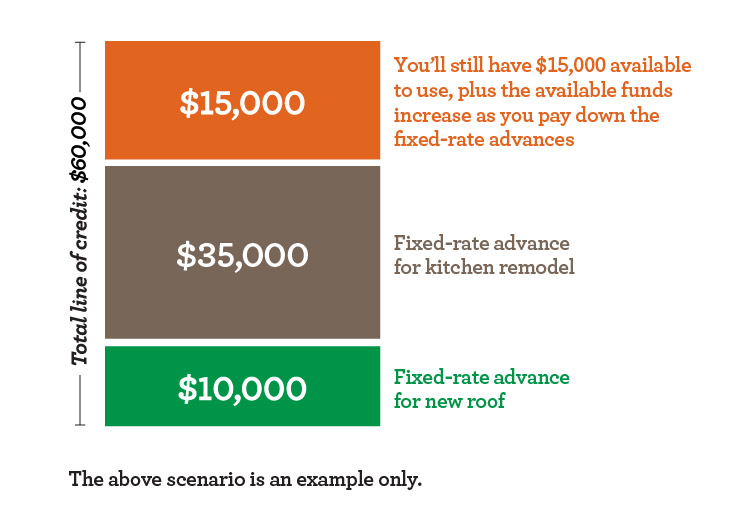

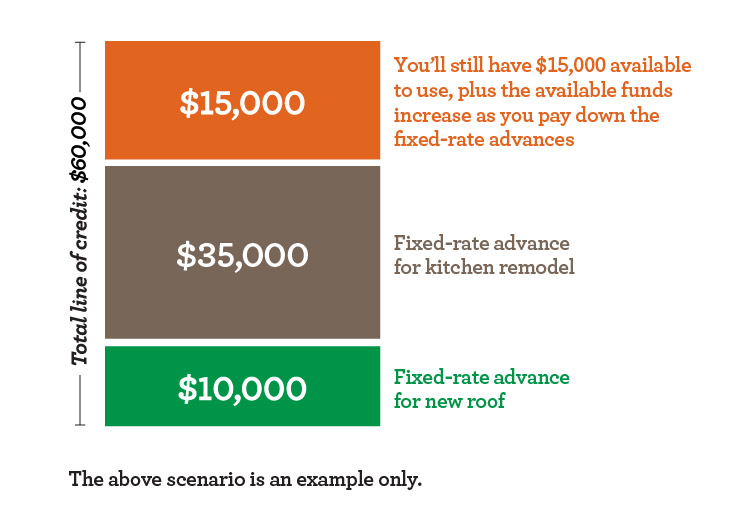

SoFi reserves the right to change or terminate this offer at any time with or without notice to you. Additionally, if you take equity out on a line of credit, you can continue to draw on the HELOC during the draw period, unlike the single one-time lump sum of a home equity loan or personal loan. You can borrow from your HELOC, start paying it back, and then borrow again on it, up to the limit. If you’ve got equity in your home, consider a home equity line of credit with SoFi.

SoFi is a well-established online lender that offers unsecured personal loans throughout most of the United States, excluding Mississippi. The company offers an online experience, and most users get feedback on their loan status within two to four days. Both also require a review of the borrower’s financial situation to determine a loan rate, and both options come with a similar set of fees. Cash-out refinancing is not taking out a second mortgage—it’s getting a new first mortgage. The minimum credit score for a home improvement loan is 660 for most lenders.

No comments:

Post a Comment